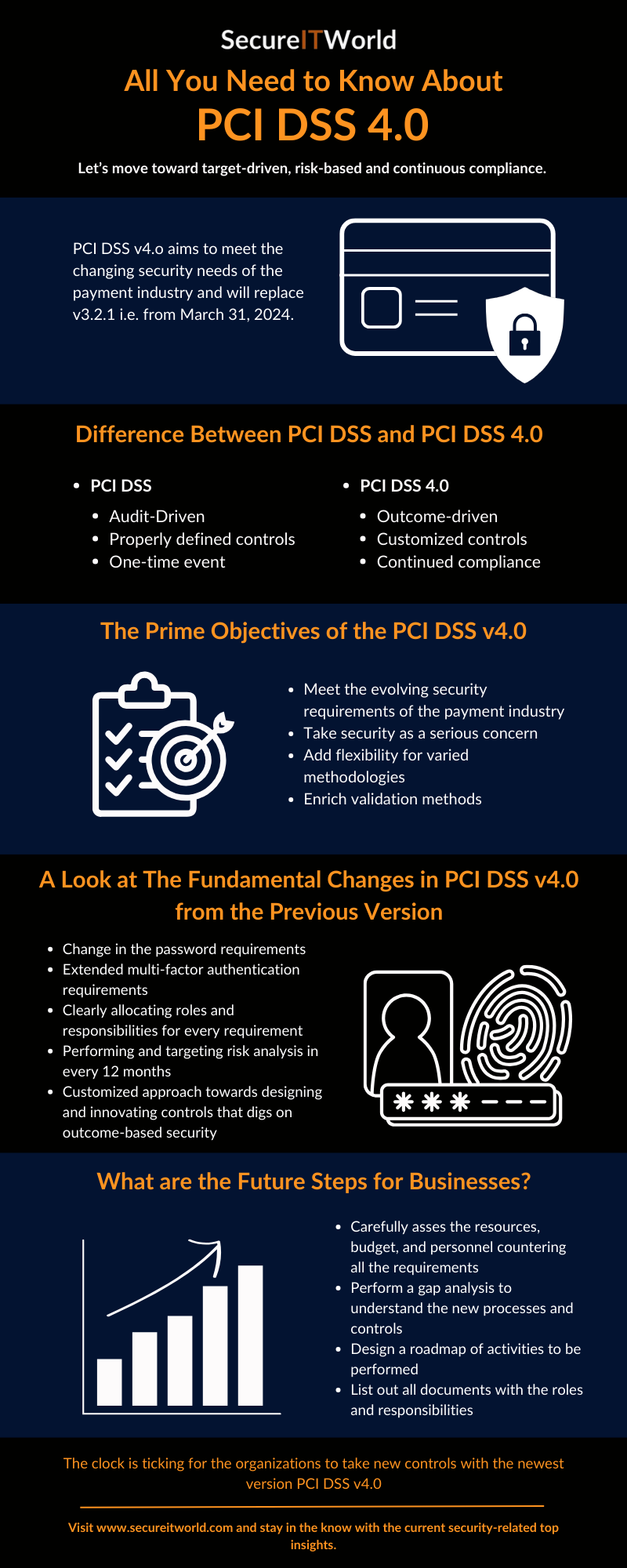

Payment Card Industry Data Security Standard, also known by its acronym, PCI DSS, is a global regulatory body that creates regulations and procedures ensuring the security of debit, credit, and cash card transactions. The latest version of these standards is PCI DSS 4.0.

Its fourth and latest version is determined to accomplish the transformation of security requirements in different types of cashless transactions. It is set to be operational from 31st March, 2024.

What differences can we expect of PCI DSS 4.0 from its earlier version?

Payment Card Industry Data Security Standard 4.0 will be outcome-driven, whereas its previous version was audit-driven. The former will offer customized controls, but the latter could only define controls properly. PCI DSS 4.0 is designed for continued compliance; however, the former version offered a one-time event.

Essential changes we can observe in Payment Card Industry Data Security Standard 4.0:

- Changes in password setting factors

- Enhanced multi-factor authentication

- Transparent roles and responsibility allocation

- Risk analysis once a year

- Customizable controls with an outcome-based security

Also Read: