Technology is an essential element of this digital world. Our daily tasks such as online shopping, work from home, social media, and other tasks that we perform online are possible because of the internet. As the internet brings so many benefits it brings some disadvantages too.

Among them one is cybercrime, where hackers steal the data from your device to perform illegal activities. And to prevent the loss caused due to such cybercrime or attacks the term cyber insurance was introduced to protect and secure us from cyber threats and lawsuits. In this blog, we will understand what this insurance is and its importance.

What is Cyber Insurance?

Cyber insurance is a form of insurance that protects businesses and individuals from financial loss in the event of a cyberattack. It provides coverage for various cyber-related risks that includes hacking, data theft, to ransomware. In case a cyber theft or attack happens, this insurance helps to pay for legal fees, notifying affected customers, recovering lost data, and repairing damaged systems.

For instance, according to a published report, the frequency and value of large cyber insurance claims increased by 14% and 17%, respectively, in the first half of 2024 compared to the previous year.

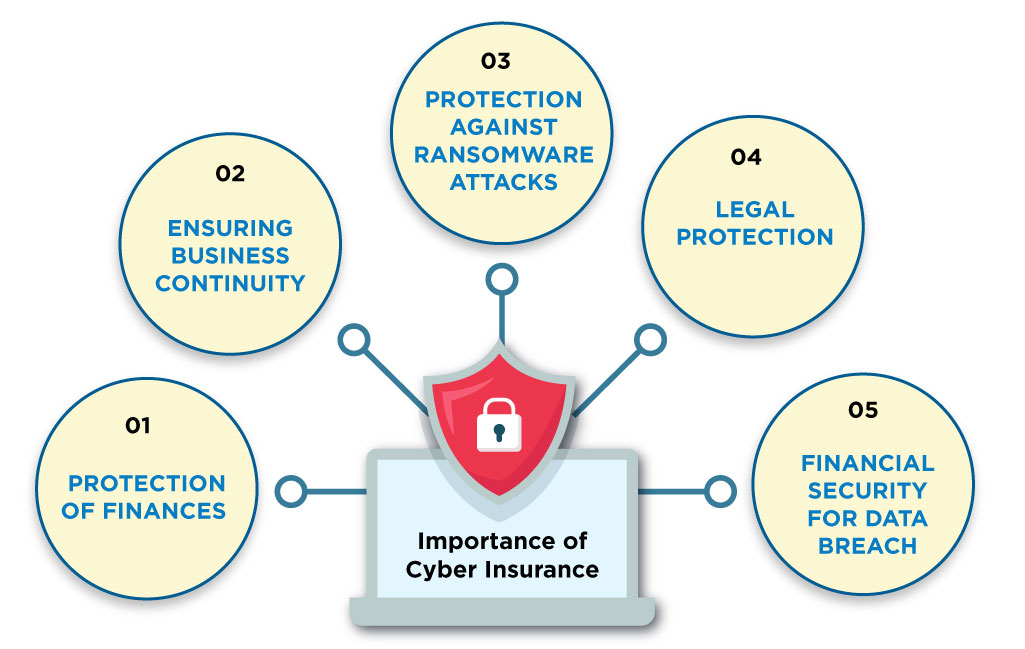

Why Cyber Insurance is Important?

Cyber insurance plays an important role in managing the risk associated with cyber threats. A cyberattack can lead to significant financial losses for businesses that include direct response costs, loss of customer trust, damage to reputation, and legal penalties.

It makes sure that the business or individual affected by cyber-attacks recovers and continues to work further in a hassle-free manner. Here are some benefits of this insurance,

Protection of Finances

The most evident benefit that this insurance provides is financial protection. The cost of data recovery, legal fees, and damage control could be high in the event of a cyberattack. These expenses are covered by cyber insurance, saving both individuals and companies from financial ruin. The cost of lost income during the recovery phase may be partially covered through this insurance.

Ensuring Business Continuity

Damages resulting from an attack are not covered by cyber insurance. The company can continue to function both during and after a cyberattack with the support of numerous policies. Funding for IT support, emergency response teams, and system recovery may fall under this category. It will have minimal downtime and continue to function properly with the help of this insurance's business continuity support.

Protection Against Ransomware Attacks

Holding up the company for ransom can be expensive for cybercriminals. They take over business computers and demand a ransom to unlock them. Cybercriminals' attacks can be extremely costly and even disastrous for business endeavors. In addition to other expenses for system restoration and data recovery, cyber insurance is beneficial for ransom payments when appropriate.

Legal Protection

Businesses may face legal problems following a cyberattack, including customer lawsuits or regulatory body fines. The cost of legal fees is partially covered by this insurance. Numerous laws give companies access to professionals who can assist them in navigating these legal issues. It also assists companies in adhering to data protection regulations, making sure they fulfill the necessary requirements.

Financial Security for Data Breach

Data breach means accessing the computer system without any authorization and gathering private data from it. Such type of attack harms the reputation of the company. Here, cyber insurance informs individuals affected by the breach and provides services like credit monitoring. It can also be used for legal costs. This way, the companies don't have to pay all the costs themselves in case of a breach.

Final Words!

Cyber insurance is a must-have for every business today. With increasing cyber threats, the right insurance can be the difference between losing money and being protected, allowing you to recover quickly from an attack. For companies and people, knowledge regarding potential cybercrime risks must make them invest in this insurance as part of the security protection package. This technology-based world is likely going to save you, starting with the insurance end.

To learn more, visit us at SecureITWorld!

FAQ

Q. Is it worth having cyber insurance?

Yes, it is worth it, as it helps to protect your business from money losses due to cyber-attacks and makes recovery easier.

Q.What is cyber risk?

Cyber risk means the possible dangers that can hurt your business online, like data breaches or hacking.

Q.Why is it difficult to get cyber insurance?

Getting cyber insurance can be tough because companies need to share a lot of details about their security, and many still do not have any strong protections.

Q. How old is cyber insurance?

Cyber insurance has been around for about 20 years, but it is become more important recently because cyber threats are increasing.

Also Read: